Public finance is a big part of how a country’s economy grows. It includes what the government spends, how it collects taxes, and money it borrows. In developing countries, over 25% of the economy depends on this. But figuring out how public finance affects growth is tricky.

Experts and policymakers need to understand the link between public finance and growth. They look at how different aspects, like the government’s size, spending efficiency, and tax systems, influence the economy. This understanding helps shape better policies for everyone.

Key Takeaways

- Public finance accounts for over 25% of GDP in developing countries, making it a crucial factor in economic growth.

- The relationship between public finance and economic growth is complex, with mixed theoretical and empirical evidence.

- A multidimensional framework is needed to assess the quality of public finances, including the size of government, fiscal deficits and sustainability, the composition and efficiency of spending, and the structure and efficiency of revenue systems.

- The composition of government spending, rather than just the overall level of spending, can have important implications for economic growth.

- The design and implementation of public finance policies can have significant implications for the distribution of income and wealth within a society.

The Importance of Public Finance

Public finance is vital for the economy and society worldwide. It looks at how governments spend, tax, and borrow money, activities that are key parts of a nation’s economy. These actions have big effects on things like economic growth and how resources are shared.

Definition and Scope of Public Finance

Public finance studies the government’s economic role. It covers what the government spends money on, where it gets money from, and its borrowing. The relation between public services, tax laws, government debt, fiscal policies, and private businesses is also explored.

Role of Government in the Economy

Modern economies rely heavily on governments. They provide essential services like defense, education, and healthcare. Governments also step in to fix market problems, help the economy grow, and ensure fair income distribution. The way they handle their budgets impacts everyone, making it a significant part of public finance studies.

Public Finance: A Multi-Dimensional Framework

Studying how well public money is managed needs a broad view of things. By looking at many areas of spending, we understand more. This helps see how decisions by governments affect things like how rich people are, how fast the economy grows, and how we all live.

Size of Government

How big the government spends, compared to the entire money made in a country, really matters. Governments have to balance. They need to offer services people need but not tax too much or spend so much it hurts everyone’s ability to make their own money.

This careful balance is key for a healthy society and economy. Too much government spending can stop businesses from growing and keep people from improving their own lives. It’s important for a fair and growing world.

Fiscal Deficits and Sustainability

Keeping an eye on how much a government borrows is important for the future. If they borrow too much, it can lead to lots of bad things. These include higher interest that everyone has to pay, less money available for businesses in the private sector, and more chances of money problems.

Composition and Efficiency of Expenditure

How a government spends its money affects everyone. They should spend on things that help, like making sure kids get good education and that roads and bridges are built well. They also need to be smart about not wasting money on things that don’t help, like luxury items for government officials.

It’s not just about spending the money right. It’s also about spending it the right way. Making sure the money goes where it should and does what it should is very important.

Structure and Efficiency of Revenue Systems

How a country collects taxes and uses that money is very important. The goal is to tax fairly but also in a way that doesn’t stop people from trying hard. Governments need money to work but they also must not make it too hard on people to pay those taxes.

Fiscal Governance

Good management of money by the government is critical. It means they need to have good rules on how they spend and save. Also, they should let people know what they’re doing with the money and let others check to make sure they’re doing it right.

Market Efficiency and Business Environment

The way a government handles its money can make business easy or hard. Too many taxes, too many rules, or spending money badly can make it difficult for companies to grow. It can also stop people from starting their own businesses.

Public Spending and Economic Growth

The type of government spending is key, not just how much is spent. It’s split into “productive” and “unproductive” expenditures. Productive means investing in infrastructure, education, and research. Unproductive is spending on goods and services.

Productive vs Unproductive Spending

Investments in public services, human capital, and physical infrastructure boost the economy’s productivity and competitiveness. This lifts economic growth. On the flip side, government consumption spends money on day-to-day expenses, offering little long-term gain.

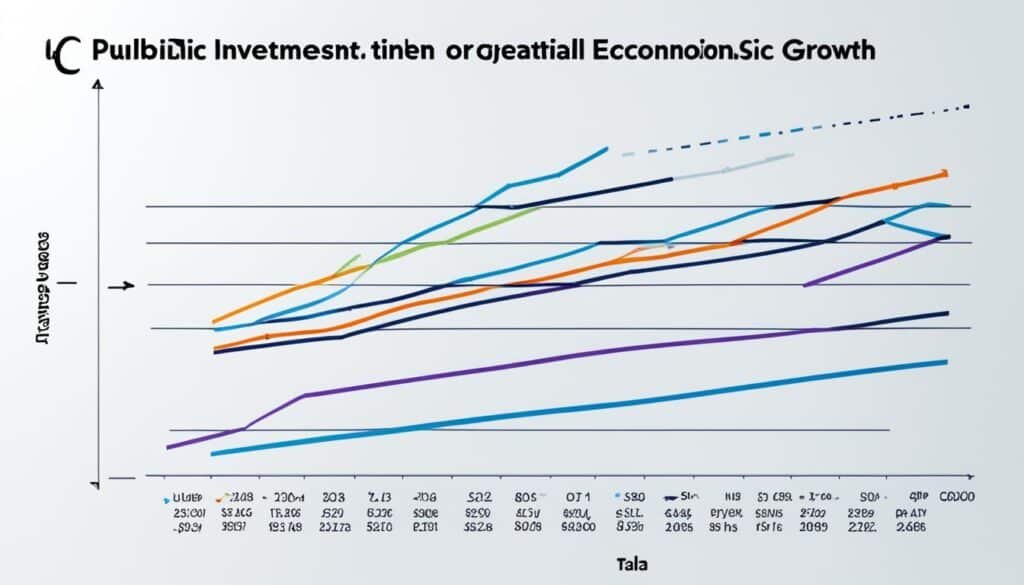

Public Investment and Growth

Empirical studies show that investing in transportation, energy, telecommunications, and education helps economic growth. The exact impact and time it takes vary. This depends on how efficient the public investment is, the economic climate, and the way it’s financed.

Policymakers need to look closely at the costs and benefits of spending. This step helps make sure public finance decisions benefit long-term economic development and productivity growth.

Public Revenue and Economic Growth

The way taxes are set up directly affects our drive to work and create new things. Taxes on income, profits, and capital can make people think twice about investing or inventing. On the other hand, consumption taxes, property taxes, and user fees might not change behavior as much. It’s a tough job for those in charge to make sure we pay what’s needed but not slow down the economy too much.

Tax Structure and Distortions

Tax rules can change how we decide to spend or save. Progressive income taxes can make us less eager to work harder or invest for the future, which slows down economic growth. In contrast, consumption-based taxes might not have these big effects. This is because they don’t mess with how much we get from working or investing.

Tax Efficiency and Compliance Costs

A smart tax system should get the right amount of money from us while causing the least trouble. Things like how hard the tax code is, how often it changes, and how well it’s enforced matter a lot. The government would like a tax system that people find fair and easy to follow. This helps everyone play by the rules without much fuss and supports a good economy.

| Tax Type | Potential Economic Impact | Compliance Considerations |

|---|---|---|

| Income Tax | Can discourage investment and innovation | Higher administrative and compliance costs |

| Consumption Tax | Generally less distortionary than income tax | Potentially lower compliance costs |

| Property Tax | May have a smaller impact on economic decisions | Requires accurate property valuations |

| User Fees | Can help align costs with benefits received | Requires effective collection and monitoring mechanisms |

Well-thought-out taxes that are easy to follow and fair can really help our economy grow. This way, the government can earn what it needs without getting in the way. It’s a key part of making sure we have the public services and help programs we rely on.

Public Finance and Income Distribution

Designing and implementing public finance policies affects how money and wealth are spread in a society. When the government spends money on things like schools, hospitals, and support for the poor, it can make society more equal. This is because it helps make sure that everyone has more of a fair chance. However, if taxes are harder on those who earn less, it can make the gap between rich and poor bigger.

A tax system that asks the wealthier to pay more can make things better. It spreads money around more fairly. Offering tax breaks and benefits for the less fortunate can also help them have a better life. Plus, when the government invests in things like roads, science, and helping people learn new skills, it can help everyone make more money. This makes our economy stronger for everyone.

Public finance policies are key in deciding who gets what in our society. By thinking about what’s fair and what helps most people, those who make the rules can make a big difference. They can make sure that when the economy grows, everyone gets a fair share. This way, more people can benefit, making our society more united and strong.

Public Debt and Economic Growth

The level and financing of public debt impact economic growth a lot. Too much government debt can weaken money’s value and raise the chance of financial crises. Also, having to pay debt back means we have less to spend on good things.

Debt Sustainability and Financing Costs

It’s important to keep public debt at a sustainable level for long-term growth. Borrowing too much can make Interest rates go up and cost more to pay back debt. This can hurt how much private companies invest and limit what the government can spend on public services. Leaders need to find a good balance in managing government debt. They should aim to spend as little as possible while making sure the debt is sustainable.

Crowding-Out Effects

Having a lot of government debt can also create crowding-out effects. This happens when the government and private businesses both need to borrow money but there isn’t enough to go around. It makes interest rates rise and reduces what companies can invest. This can slow down economic growth and stop the private sector from helping the economy get better. Leaders must be careful and think about the effects of having a lot of public debt. They need to use policies that keep a good balance between what the government and private companies invest.

Also Read : Demystifying Finance Services: Understanding Your Options and Needs

FAQs

Q: What is public finance and how does it impact economic growth?

A: Public finance refers to the management of a government’s revenue, expenditures, and debt to achieve economic stability and growth. It impacts economic growth by funding public services, infrastructure projects, and social welfare programs that contribute to a healthy economy.

Q: How do bonds play a role in public finance?

A: Bonds are a common tool used by governments to raise funds for various projects and initiatives. Investors purchase bonds as a form of lending money to the government, which in turn pays back the principal amount with interest over a specified period.

Q: What are the different types of bonds issued in public finance?

A: In public finance, governments can issue different types of bonds such as general obligation bonds, revenue bonds, municipal bonds, and taxable bonds, each serving specific purposes in financing public projects and services.

Q: How does taxation factor into public finance?

A: Taxation is a primary source of government revenue used to fund public services. Governments levy taxes on individuals, businesses, and other entities to generate income that is then allocated towards public expenditures.

Q: What is the role of investors in public finance?

A: Investors play a crucial role in public finance by purchasing government securities and bonds, providing the government with the necessary funds to finance public projects. In return, investors receive interest payments on their investments.

Q: How do state and local governments contribute to public finance?

A: State and local governments engage in public finance through the issuance of bonds, collection of taxes, and management of public funds to support essential services like education, transportation, healthcare, and public safety.

Q: How does public finance practice impact the redistribution of resources?

A: Public finance practice involves the allocation of resources through government spending, taxation, and borrowing, which can influence the redistribution of wealth and resources within a society to promote economic equity and social welfare.

Source Links

- https://www.econstor.eu/bitstream/10419/52829/1/335128726.pdf

- https://ec.europa.eu/economy_finance/publications/pages/publication13101_en.pdf

- https://oecdecoscope.blog/2018/12/17/how-can-public-finance-reforms-boost-economic-growth-and-enhance-income-equality/