Financial freedom is a goal that many people aspire to, but not everyone knows how to achieve it. By following these tips and strategies, you can work towards achieving financial independence and embrace the freedom to retire early. These strategies include creating a financial plan, setting goals, managing debt, saving and investing, and securing multiple streams of income.

Key Takeaways:

- Creating a financial plan is a crucial step in achieving financial independence.

- Set clear and specific financial goals to stay motivated on your financial journey.

- Manage debt effectively to improve your financial health.

- Save and invest wisely to grow your wealth over time.

- Secure multiple streams of income to increase financial stability.

Set Life Goals

Setting life goals is a fundamental step on the path to financial independence. By defining clear and specific objectives, you can chart a course towards the lifestyle you desire, determine the amount of money you need for comfortable living, and establish deadlines for reaching your financial milestones. It is through these goals that you can stay focused, motivated, and committed to attaining financial independence.

When setting life goals, consider the lifestyle you envision for yourself. Do you see yourself traveling the world? Starting your own business? Retiring early? Take the time to visualize what you want your life to look like and what it will require financially.

Financial goals should be challenging but realistic. Identify the amount of money you need to live comfortably and achieve the lifestyle you desire. This can include factors such as housing, healthcare, education, travel, and recreational activities. Calculate these expenses and set tangible objectives that align with your aspirations.

Retirement planning is an essential aspect of setting life goals. Determine when you want to retire and the financial resources you will require to maintain the lifestyle you desire during your golden years. By setting a retirement savings target, you can work towards accumulating the necessary funds and achieve financial independence when the time comes.

Creating a plan to achieve your life goals is crucial. Break down your goals into manageable steps and establish a timeline for each milestone. This will help you stay on track and measure your progress along the way. Regularly reviewing your goals and adjusting your plan as needed ensures that you remain aligned with your ultimate objective of achieving financial independence.

Remember, setting life goals is not just about financial planning. It’s about creating a meaningful and fulfilling life. Financial independence is a means to an end, allowing you to pursue your passions, spend time with loved ones, and make a positive impact. Set your life goals with intention and let them guide you on your journey to financial independence.

Make a Monthly Budget

Creating and following a monthly household budget is a crucial step towards achieving financial independence. Budgeting allows you to track your income and expenses, ensuring that all your financial needs are covered and that you are saving and investing wisely. By identifying and understanding your spending habits, you can make informed decisions about where to allocate your money.

Why Budgeting Matters

“Budgeting is not just about numbers; it’s about discipline and control over your financial future.” – Dave Ramsey

A well-planned budget provides a roadmap for your financial journey. It enables you to set clear financial goals and prioritize your spending. By allocating specific amounts to different categories, such as housing, transportation, groceries, entertainment, and savings, you can ensure that your money is being used efficiently and in line with your priorities.

Additionally, a budget helps you identify areas where you can cut back on expenses and save more money towards your financial goals. It allows you to understand your spending patterns and make adjustments as needed. By tracking your expenses, you may discover unnecessary or frivolous spending habits, which can be eliminated to free up funds for more important things.

The Budgeting Process

The first step in creating a monthly budget is to determine your income. This includes any salary, wages, tips, rental income, or other sources of money. By knowing your total monthly income, you can develop a realistic budget that aligns with your financial situation.

Next, you need to list all your expenses. Start with the fixed costs, such as rent or mortgage payments, utilities, and insurance premiums. Then, include variable expenses, such as groceries, dining out, transportation, entertainment, and clothing. Be thorough in noting down all your expenses, including both essential and discretionary items.

Once you have listed your income and expenses, subtract your expenses from your income to see if you have a surplus or a deficit. If you have a surplus, you can allocate the extra money towards savings, investing, or paying off debt. If you have a deficit, you may need to reevaluate your spending and find areas where you can make cuts.

It’s important to review and adjust your budget regularly. Life is dynamic, and your financial situation may change over time. Periodically revisit your budget to accommodate any changes in income, expenses, or financial goals. This ongoing evaluation ensures that your budget remains relevant and effective in helping you achieve financial independence.

A Sample Monthly Budget

| Category | Amount |

|---|---|

| Housing | $1,200 |

| Utilities | $200 |

| Transportation | $300 |

| Groceries | $400 |

| Dining Out | $150 |

| Entertainment | $100 |

| Savings | $500 |

This is a sample monthly budget to illustrate how expenses can be categorized. Your specific budget may differ based on your unique circumstances and goals. The key is to ensure that your income covers all your essential expenses while leaving room for savings and investing.

The Benefits of Budgeting

- Financial Planning: Budgeting helps you plan for both short-term and long-term financial goals. It allows you to allocate resources wisely and make progress towards achieving financial independence.

- Spending Habits: By tracking your expenses, you become more aware of your spending habits and can make conscious decisions to prioritize what is truly important to you.

- Habit Formation: Regular budgeting helps in developing disciplined financial habits. It encourages mindful spending and prevents impulsive purchases.

- Debt Management: Budgeting allows you to allocate funds towards paying off debt systematically. It helps you avoid accumulating unnecessary debt and work towards financial stability.

By making a monthly budget and sticking to it, you take control of your financial future. Budgeting is the foundation of successful financial planning and a vital practice for achieving long-term financial independence.

Pay off Credit Cards in Full

Credit card debt can be a major obstacle to achieving financial independence. By paying off credit cards in full and minimizing your overall debt, you can improve your financial health and increase your credit score. It’s important to prioritize paying off high-interest debt and avoid carrying a balance on your credit cards.

Carrying high-interest credit card debt can be costly and hinder your progress towards financial independence. Interest charges can accumulate quickly and make it difficult to get ahead financially. By committing to paying off your credit cards in full each month, you can avoid these interest charges and keep more money in your pocket.

Additionally, paying off credit cards in full can have a positive impact on your credit score. Your credit score is a numerical representation of your creditworthiness and is used by lenders to assess your financial reliability. By keeping your credit card balances low and paying them off in full, you demonstrate responsible credit management, which can boost your credit score.

When prioritizing which credit cards to pay off, focus on those with the highest interest rates first. By eliminating high-interest debt, you can save money on interest payments and free up more funds to put towards achieving your financial goals.

To ensure that you can pay off your credit cards in full each month, it’s important to manage your expenses and budget effectively. Take a close look at your spending habits and identify areas where you can cut back to save more money. By living within your means and avoiding unnecessary purchases, you’ll have more financial resources available to pay off your credit card debt.

“Paying off credit cards in full and minimizing debt is essential for achieving financial independence and improving your credit score.”

By making a conscious effort to pay off your credit cards in full, you can reduce your debt, improve your credit score, and take significant steps towards achieving financial independence.

Create Automatic Savings

When it comes to achieving financial independence, creating automatic savings is a powerful tool. By setting up automated contributions to your retirement plan and emergency fund, you can ensure consistent saving for the future, protecting yourself from unexpected expenses and building a strong financial safety net.

One effective way to create automatic savings is by contributing to your employer’s retirement plan. By allocating a percentage of your paycheck directly into your retirement account, you can effortlessly build a nest egg for your future. This not only helps you save for retirement but also takes advantage of any employer-matching contributions, maximizing your savings potential.

Additionally, setting up automatic withdrawals into an emergency fund can provide you with much-needed financial security. An emergency fund is essential for unexpected situations, such as medical expenses or home repairs, and having automatic contributions to this fund ensures that you are consistently building it up over time.

By automating your savings, you eliminate the need for conscious decision-making and can seamlessly meet your financial goals. It removes the temptation to spend the money elsewhere and reinforces the habit of saving, ultimately contributing to your long-term financial success.

The Benefits of Automatic Savings:

- Consistency: Automatic savings guarantee that you consistently set aside money for the future, enabling you to reach your financial goals more effectively.

- Discipline: By automating your savings, you develop the discipline of setting money aside regularly, reinforcing healthy financial habits.

- Financial Safety Net: Creating an emergency fund through automatic savings ensures that you have a financial safety net to fall back on in case of unexpected expenses or emergencies.

- Peace of Mind: Automatic savings provide peace of mind, knowing that you have taken proactive steps to secure your financial future and protect yourself from unforeseen circumstances.

To further illustrate the benefits of automatic savings, consider the following table:

| Scenario | Manual Savings | Automatic Savings |

|---|---|---|

| Consistency | Dependent on individual discipline | Guaranteed regular contributions |

| Effort | Requires continuous monitoring and manual transfers | Automated process, minimal effort required |

| Results | Inconsistent savings, potential for missed contributions | Consistently growing savings over time |

As shown in the table, automatic savings provide a more consistent and effortless approach to saving, ensuring that you stay on track with your financial goals.

As an additional visual aid, here is an image that represents the concept of automatic savings:

By creating automatic savings, you are taking significant steps towards financial independence. It’s important to regularly review and adjust your savings contributions to ensure they align with your financial goals and current circumstances. With automatic savings in place, you can have peace of mind, knowing that you are building a solid foundation for your future.

Start Investing Now

Investing is a key component of achieving financial independence. By starting to invest early and taking advantage of compound interest, you can grow your money over time. While investing in the stock market carries some risks, it has historically been one of the best ways to build long-term wealth. Consider opening an online brokerage account and regularly contributing to your investment portfolio.

When it comes to investing, time is your greatest ally. The power of compound interest allows your investments to grow exponentially over the long term. By reinvesting your investment returns, you can earn additional returns on your initial investment as well as the accumulated earnings. This compounding effect can significantly boost your retirement savings. Don’t wait, start investing now and give your money the opportunity to work for you.

Investing in the stock market offers substantial growth potential, albeit with inherent risks. However, by diversifying your portfolio across different asset classes and staying invested for the long term, you can mitigate risks and potentially earn attractive returns. It’s important to develop a well-informed investment strategy and regularly review your investments to ensure they align with your financial goals.

Remember, investing is a long-term game, and it’s important to have a disciplined approach. Stay focused on your financial goals and resist the temptation to make impulsive investment decisions based on short-term market fluctuations.

Key Points:

- Start investing early to take advantage of compound interest.

- Consider opening an online brokerage account for convenient and affordable access to the stock market.

- Diversify your investment portfolio to reduce risks and maximize potential returns.

- Develop a sound investment strategy and regularly review your investments to ensure they align with your financial goals.

- Stay disciplined and focused on your long-term financial objectives, avoiding impulsive decisions based on short-term market movements.

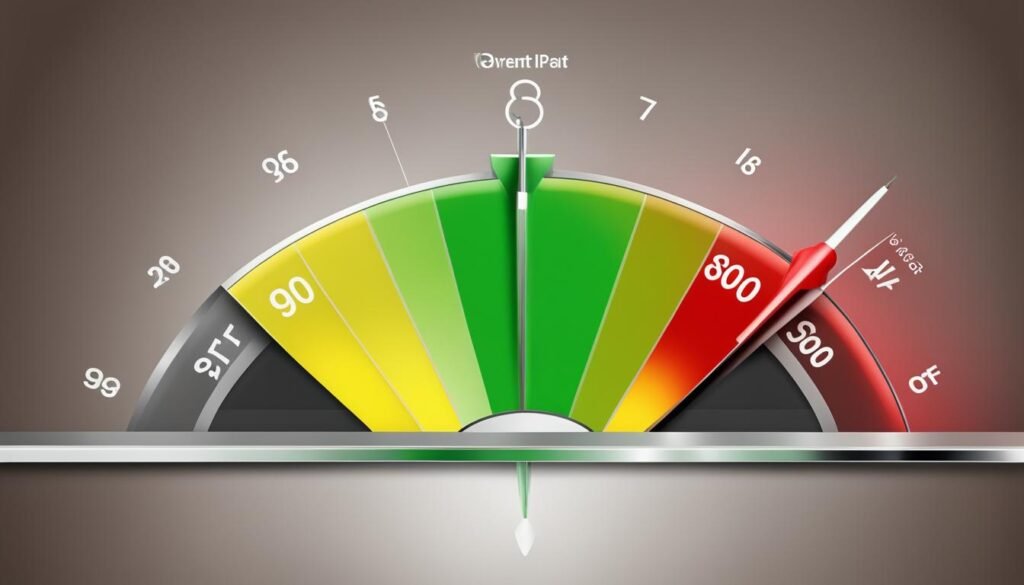

Watch Your Credit Score

Your credit score is a critical factor in your overall financial health. It not only affects your ability to secure loans and favorable interest rates but can also impact insurance premiums. To ensure you have access to financial opportunities and protect your financial well-being, it’s essential to regularly check your credit report and maintain a good credit score.

Monitoring your credit report allows you to stay informed about your financial standing and identify any errors or discrepancies that may be negatively impacting your credit score. By reviewing your credit report regularly, you can take the necessary steps to correct any inaccuracies and ensure your credit score reflects your true financial status.

Managing your credit score goes beyond simply checking your credit report. It includes adopting healthy financial habits that contribute to a positive credit history. These habits include making timely payments, keeping credit card balances low, and minimizing new credit applications. By demonstrating responsible credit behavior, you can improve your credit score and enhance your financial profile.

Additionally, a good credit score opens doors to various financial opportunities. It increases your chances of securing loans with favorable interest rates, which can save you money in the long run. It also demonstrates your financial reliability, leading to better insurance premiums and rental agreements.

To effectively monitor your credit score and maintain financial health, consider the following tips:

- Check your credit report regularly: Review your credit report annually from each of the three major credit bureaus – Experian, Equifax, and TransUnion. Look for any errors or discrepancies and address them promptly.

- Pay your bills on time: Timely payment of your debts is crucial for maintaining a good credit score. Set up payment reminders or automatic payments to avoid late payments.

- Keep credit card balances low: Aim to keep your credit card balances below 30% of your available credit limit. High credit card utilization can negatively impact your credit score.

- Minimize new credit applications: While it’s important to have a healthy mix of credit, applying for multiple credit accounts within a short period can lower your credit score due to the resulting hard inquiries.

- Utilize credit responsibly: Use credit responsibly by borrowing only what you can afford to repay and avoiding maxing out your credit limits.

By being proactive and vigilant about your credit score, you can ensure your financial stability and improve your chances of achieving long-term financial success.

| Credit Score Range | Credit Rating |

|---|---|

| 300–579 | Poor |

| 580–669 | Fair |

| 670–739 | Good |

| 740–799 | Very Good |

| 800–850 | Excellent |

Negotiate for Goods and Services

When it comes to saving money, negotiation is a powerful tool that is often overlooked. Many people are hesitant to negotiate for goods and services, whether it’s because they feel uncomfortable or are unsure of the process. However, mastering the art of negotiation can lead to significant savings and discounts, helping you achieve your financial goals.

Whether you’re buying a car, negotiating rent, or purchasing a large quantity of goods, negotiating can help you secure a better deal. Small businesses and vendors are often open to negotiation, especially if it means making a sale or maintaining a loyal customer. By being proactive and assertive, you can take advantage of this opportunity to save money.

“Negotiation is not about winning or losing; it’s about reaching a mutually beneficial agreement.”

How to Negotiate Effectively

To negotiate successfully, it’s important to do your research and be prepared. Start by gathering information on the typical price range for the product or service you’re interested in. This will give you a baseline to work with and help you assess the value of any discounts you may receive.

Next, approach the negotiation with confidence and a friendly attitude. Clearly communicate your needs and expectations, presenting any relevant facts or data to support your position. Be prepared to compromise and find common ground, focusing on reaching a mutually beneficial agreement.

Here are some key tips to keep in mind when negotiating:

- Know your budget and desired outcome.

- Be respectful and polite throughout the negotiation process.

- Highlight the value you bring as a customer.

- Consider offering alternative solutions or payment options.

- Be patient and willing to walk away if the deal doesn’t meet your criteria.

The Benefits of Negotiation

By incorporating negotiation into your financial strategy, you can enjoy a range of benefits. Firstly, negotiating can lead to immediate savings and discounts, reducing your overall expenses. These savings can then be redirected towards your financial goals, such as building an emergency fund or investing for the future.

Secondly, mastering the art of negotiation can boost your confidence and assertiveness, which can have positive effects on various areas of your life. Negotiating effectively requires you to clearly articulate your needs, listen actively, and find creative solutions, skills that are valuable in both professional and personal relationships.

Finally, negotiation can help you develop strong relationships with vendors and service providers. By demonstrating your loyalty and commitment to ongoing business, you may gain access to exclusive discounts or special offers in the future.

An Example of Successful Negotiation: Bulk Purchasing

One notable example of the power of negotiation is bulk purchasing. Whether you’re buying office supplies for your business or stocking up on household essentials, negotiating bulk discounts can result in substantial savings.

Let’s take a look at the potential savings when negotiating a bulk purchase of office supplies:

| Item | Regular Price | Negotiated Price | Savings |

|---|---|---|---|

| Paper | $10 per ream | $8 per ream | $2 per ream |

| Pens | $1 each | $0.75 each | $0.25 each |

| Notebooks | $5 each | $4 each | $1 each |

In this example, by negotiating a 20% discount on each item, you can save $2 per ream of paper, $0.25 per pen, and $1 per notebook. If you’re purchasing a large quantity of these items, the savings can quickly add up, contributing to your overall financial independence.

Remember, negotiations are not limited to one-time purchases but can also be applied to ongoing services such as internet or cable subscriptions. By regularly reviewing your expenses and looking for opportunities to negotiate, you can continue to save money and maximize your financial independence.

Stay Educated on Financial Issues

Staying informed and educated about financial issues is vital for achieving financial independence. By keeping up with the latest financial news, understanding tax-law changes, and staying updated on investment strategies, you can make informed decisions about your money. Financial education is key to developing the necessary skills and knowledge to navigate the complex world of personal finance.

Benefits of Financial Education

Investing time in financial education can have numerous benefits in your journey towards financial independence. Here are some of the advantages of expanding your investment knowledge and financial literacy:

- Improved decision-making: With a solid understanding of financial concepts, you can make better decisions about your investments, budgeting, saving, and debt management.

- Risk management: Financial education equips you with the tools to assess and manage risks, helping you protect your financial investments and assets.

- Identifying opportunities: Staying educated about financial issues allows you to identify new investment opportunities and take advantage of market trends.

- Protecting against scams: Being knowledgeable about financial matters helps you recognize and avoid fraudulent schemes, protecting your hard-earned money.

- Increased confidence: The more you know about financial topics, the more confident you will feel when making important financial decisions.

Resources for Financial Education

To stay educated on financial issues, you can leverage various resources that provide valuable information and insights. Here are some recommended resources to expand your financial literacy:

- Books: There are many books available that cover a wide range of financial topics, from basic money management to advanced investment strategies.

- Online courses: Numerous online platforms offer comprehensive financial education courses that you can complete at your own pace.

- Personal finance blogs and websites: Follow reputable personal finance blogs and websites that provide tips, guides, and expert advice.

- Financial podcasts: Listening to financial podcasts can be an engaging way to gain insights and learn from industry experts.

- Seminars and webinars: Attend financial seminars or participate in webinars that cover specific financial topics or investment strategies.

Continual Learning for Financial Independence

Financial education is a lifelong journey. As the financial landscape evolves, it’s important to stay updated and adapt to changing circumstances. Continual learning ensures you remain equipped with the knowledge and skills necessary to make sound financial decisions. Regularly explore new resources and seek opportunities to expand your financial education.

Remember, a financially educated individual is empowered to take control of their financial future, develop effective strategies for wealth creation, and ultimately achieve the much-desired financial independence.

Invest in your financial education today and unlock the potential for a brighter financial future.

Live Below Your Means

Living below your means is a fundamental principle of achieving financial independence. By distinguishing between wants and needs and making small adjustments to your lifestyle, you can save more money and prioritize financial goals. It’s important to develop a mindset focused on living a good life with less and avoid unnecessary expenses that can hinder your financial progress.

Frugal Lifestyle

Embracing a frugal lifestyle is key to living below your means. This means being mindful of your spending habits and finding ways to cut back on unnecessary expenses. Consider buying used items, shopping for discounts and deals, and finding free or low-cost alternatives for entertainment and leisure activities.

Creating a Budget

A budget is a powerful tool for living below your means. By carefully planning and allocating your income towards essential expenses, savings, and investments, you can ensure that you are not overspending and living paycheck to paycheck. Use a budgeting app or spreadsheet to track your expenses and identify areas where you can make adjustments.

Saving and Investing

Living below your means also involves saving and investing a portion of your income. Set saving goals and automate transfers to a separate savings account. This way, you’re less likely to dip into your savings for unnecessary purchases. Additionally, explore investment opportunities that align with your risk tolerance and financial goals to grow your wealth over time.

Focus on Value

When making purchasing decisions, focus on value rather than price alone. Look for quality products and services that offer long-term benefits and durability. Avoid impulse purchases and take the time to research and compare prices and reviews to ensure that you are getting the most value for your money.

By adopting a frugal lifestyle, creating a budget, saving and investing wisely, and focusing on value, you can live below your means and improve your financial health. Remember, it’s about aligning your spending with your long-term financial goals and embracing a mindset of conscious and intentional living.

Conclusion

Achieving financial freedom requires discipline, careful planning, and the development of good financial habits. By prioritizing your financial goals, creating a budget, managing debt responsibly, saving and investing wisely, and living below your means, you can work towards securing your financial independence.

Setting clear and specific goals is crucial for mapping out your financial journey. With a well-defined plan in place and a timeline for achieving milestones, you can stay focused and motivated, making informed decisions that align with your vision of financial success.

Staying educated about financial matters is key to making informed choices. By regularly seeking knowledge and staying updated on financial news, tax laws, and investment strategies, you can equip yourself with the necessary tools to navigate the complex world of finance.

Remember that seeking professional advice when needed can provide valuable insights and guidance. Financial advisors can offer personalized solutions based on your specific circumstances, helping you make sound financial decisions that align with your goals.

By implementing these strategies and maintaining strong financial habits, you can pave the way to financial freedom. Achieving financial independence will not only provide you with peace of mind but also unlock the possibility of retiring early and living life on your own terms.

Also Refer : Smart Financial Planning Tips For Success

FAQs

Q: What is the FIRE movement?

A: The FIRE movement, which stands for Financial Independence, Retire Early, is a lifestyle movement aimed at gaining financial independence and retiring at a younger age than the traditional retirement age.

Q: How can I become financially independent?

A: To become financially independent, you need to save enough money to cover your living expenses without relying on a traditional job. This can be achieved by increasing your income, reducing expenses, and saving and investing wisely.

Q: What are some variations of the FIRE movement?

A: There are several variations of the FIRE movement, such as LeanFIRE, where individuals aim to reach financial independence with minimal expenses, and FatFIRE, where individuals have higher spending and saving goals.

Q: How do I calculate my FI number?

A: Your FI number is calculated by estimating your annual living expenses and multiplying that number by 25. This rule of 25 indicates the amount you need to save to achieve financial independence, assuming a 4% withdrawal rate.

Q: What is the savings rate in the context of financial independence?

A: The savings rate refers to the percentage of your income that you save and invest toward reaching financial independence. A higher savings rate can accelerate your journey to financial independence.

Q: What does financial independence mean?

A: Financial independence means having enough income or savings to cover your living expenses without the need to work for an employer. It provides the freedom to pursue your passions and interests without financial constraints.

Q: What is the goal of the FIRE movement?

A: The goal of the FIRE movement is to achieve financial independence and, if desired, retire early from traditional employment, allowing individuals to live life on their own terms and focus on their interests and passions.

Q: How can I increase my chances of reaching financial independence?

A: You can increase your chances of reaching financial independence by saving diligently, investing wisely, increasing your income through side hustles or career advancement, and being mindful of your expenses and lifestyle choices.

Q: Are there different types of FIRE participants?

A: Yes, there are various types of FIRE participants, including those pursuing LeanFIRE with minimalist living, those aiming for FatFIRE with higher spending, and those considering BaristaFIRE which involves working part-time after reaching financial independence.

Q: Who are some notable figures associated with the FIRE movement?

A: Notable figures associated with the FIRE movement include Vicki Robin, co-author of the book “Your Money or Your Life,” and Joe Dominguez, who popularized the concept of financial independence and early retirement through the book and program “The Simple Living Guide.”

Source Links

- https://www.investopedia.com/articles/personal-finance/112015/these-10-habits-will-help-you-reach-financial-freedom.asp

- https://www.td.com/us/en/personal-banking/finance/achieve-financial-independence

- https://www.ramseysolutions.com/retirement/what-is-financial-freedom